The Netflix, Warner Bros & Paramount Clash: Hollywood’s Surrender to Streaming Supremacy?

The Netflix, Warner Bros & Paramount Clash: Hollywood’s Surrender to Streaming Supremacy?

In a seismic M&A deal announced on December 5th, 2025, Netflix agreed to acquire Warner Bros. Discovery’s (WBD) film and TV studios and HBO Max for an enterprise value of $82.7 billion, outbidding rival bidders in a cutthroat auction. Shareholders will receive $23.25 in cash and $4.50 in Netflix stock per WBD share, folding icons like Game of Thrones, The Big Bang Theory, and the DC Universe into Netflix’s product portfolio. Immediately following this announcement, Paramount Skydance swiftly countered with a hostile $108.4 billion all-cash bid at $30 per share for all of WBD including cable assets like CNN and TNT claiming superior value and regulatory ease. While investment bankers and underwriters celebrate with fervour, eager to represent either side of the deal and extolling their supposed trust and the transformative power of the deal, it is essential to pause and reflect. This acquisition must be examined not only as a momentous financial transaction in the history of M&A, but within but within the broader arc of cinematic history and the uncertain future of artistic filmmaking under the weight of corporate consolidation and profit-driven uniformity.

History of Filmmaking in Hollywood

Hollywood’s cinematic giants once thrived on the iron grip of vertical integration between the 19th and 20th centuries: studios commanded production, distribution and theatres, giving rise to the traditional studio system that dominated the 30s and 40s. That monopoly was shattered by the 1948 Paramount Decree, a landmark ruling that forced divestitures and cracked open the gates to independent filmmaking. This ushered in an era of unprecedented diversity, creativity and artistic risk where films competed for both critical acclaim and widespread popularity. Notable extensions to this ew age of cinema include the post-war New Hollywood of the 1970s with auteurs like Coppola and Scorsese and the rise of critically-acclaimed films such as Lawrence of Arabia and Space Odyssey. The trajectory of theatres and in-person cinemas was then flipped by the infamous blockbuster age of the 1980s, sparked by Jaws and Star Wars, turning movies into global events, bolstered by VHS home video and associated improvements in TV hardware. Despite its economic success, blockbuster films were characterised by a focus on high-budget, mass-appeal films, leading to several critiques including a lack of original ideas, formulaic content and the marginalisation of smaller films. As the blockbuster trajectory evolved, studios increasingly catered to their most lucrative customer segments, neglecting the middle 50% of the market. Into this critical gap stepped Netflix, positioning itself as the champion of underserved audiences and redefining how and what stories were told. The Netflix’s 1997 DVD-by-mail launch exemplified Clayton Christensen’s disruptive innovation theory, starting low-end with cheap rentals to underserved customers, then pivoting to streaming in 2007 as broadband matured, bankrupting Blockbuster by 2010 and triggering the digital deluge. Today, this deal circles back to the monopoly age with Netflix reassembling vertical control over content and distribution signifying its ulterior anxiety of being victimised to another wave of digital disruption.

Netflix’s and WB’s Motives

Netflix’s motives extend beyond immediate financial gains. Like any M&A deal, it is the synergies derived from the deal that ultimately determine the intrinsic worth of such a seismic deal. Netflix already projects that its deal will deliver $5-7 billion in annual synergies from combining technology platforms, cross-promoting subscribers and integrating Warner’s vast IP library, which will help offset its maturing growth after reaching 300 million global users. For Warner Bros. Discovery, burdened by over $40 billion in debt from its 2022 merger and ongoing subscriber losses at HBO Max, the deal provides much-needed cash infusion while allowing a spin-off of non-core cable networks like CNN and TNT by Q3 2026 to navigate regulatory approval. From a pre‑due diligence perspective, this financial logic appears sound for both companies: Netflix secures long‑term growth through scale and operational feasibility, while Warner Bros Discovery gains liquidity and regulatory breathing room to stabilise its debt‑laden balance sheet. However, on a deeper level, the motives of this deal seem to extend beyond the optimisation of synergies to an intrinsic need for content dominance. By acquiring the key components of WB, Netflix is essentially gaining access o the studio’s century-old content slate from classics like Casablanca to modern franchises like DC. This subsequently enhances its algorithmic recommendations and attracts premium subscribers who seek variety allowing it to derive value from previously untouched customer bases under Netflix’s current market positioning. Warner, meanwhile, gains stability amid Wall Street pressure, but at the cost of handing creative control to a data-focused platform that prioritises high-engagement sequels and series over experimental films. This move effectively rebuilds vertical integration in digital form, where Netflix could dominate from production to delivery, potentially controlling 40% of the U.S. streaming market and pressuring competitors like Disney+ on advertising and content costs. Through another perspective, Netflix’s deal with WB could be seen as an insurance policy hedging against the saturation of its core streaming market, the volatility of subscriber growth and the looming threat of new competitors. By locking in Warner Bros’ evergreen franchises and global distribution rights, Netflix is effectively buying resilience and safeguard against the threat of future digital disruption as Christensen’s model predicts.

Social Implications and Cinema’s Future Trajectory

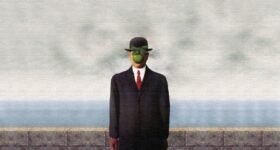

The broader social effects of a Netflix victory would reshape how we experience stories and community. Traditional cinemas, which have already seen attendance drop by 70% since the COVID-19 pandemic, would face further decline as exclusive theatrical windows shorten in favour of simultaneous streaming releases. On a psychological and cultural level, this shift replaces shared public events, like families attending a blockbuster premiere, with individualised viewing on personal devices, contributing to increased screen time (now averaging over seven hours daily for U.S. adults) and potentially heightening feelings of isolation. Algorithms would curate access to Warner’s documentaries and HBO’s investigative journalism, raising concerns about filtered narratives in an era of misinformation. One could alternatively dismiss these arguments as alarmism, but the truth remains that as generations evolve, the trajectory of cinema is bending inexorably toward a digitally‑dominated future, one where collective storytelling risks being replaced by algorithmic curation and solitary consumption. Therefore, it is not unsurprising Hollywood’s stakeholders fundamentally oppose this deal, as it reduces content diversity and erodes industry‑wide incentives to produce critically‑acclaimed films—works with the power to melt the coldest hearts and question the deepest assumptions of our society. Netflix’s reliance on viewer data favours predictable franchises, side-lining mid-budget film and underrepresented voices that thrived post-1948. If this trend continues, filmmaking could become more uniform, prioritizing profit metrics over innovation and limiting cinema’s role as a mirror for societal issues. Nevertheless, it would be interesting to see whether these trends only apply to the trajectory of the US filmmaking or whether its effects would extend to international cinema. It could possibly mean that public opposition towards Netflix could finally fuel a spotlight on the more critical-acclaimed and niche international films that are often featured and awarded at the Cannes’s Film Festival?

Paramount’s Role: Potential Hope or Another Layer of Consolidation?

Paramount Skydance’s aggressive $108 billion all-cash counteroffer introduces a counter-narrative, positioning it as a possible alternative to Netflix’s dominance. By targeting the entirety of WBD including studios, HBO Max, and linear networks like CNN and TNT the bid promises $6 billion in cost synergies through streamlined operations, shared sports rights, and combined ad sales, without the need for complex spin-offs. Proponents argue this preserves more jobs (potentially 20,000+ across both firms) and maintains a hybrid model blending theatres, streaming, and cable, which could sustain cinema chains longer than Netflix’s streaming-first approach. However, critics view it as corporate greed in disguise: Skydance, backed by private equity, seeks its own scale to compete, absorbing valuable assets like TNT’s NBA rights while risking regulatory blocks due to overlapping media holdings. Analytically, Paramount might “save” elements of legacy Hollywood such as Warner’s theatrical commitments and diverse production arms fostering competition that encourages varied content slates. Yet it delays, rather than prevents, consolidation; a Paramount-WBD entity would still control significant market share, echoing pre-1948 monopolies and potentially leading to higher consumer prices without guaranteed creative protections. To add another layer of political controversy, Paramount’s CEO, David Ellison (son of Oracle’s Larry Ellison) has deep ties to President Trump’s inner circle. Would this change the way Paramount is viewed in this hostile M&A landscape and if successful, what would it mean for the future of progressive media?

This high-stakes bidding war underscores Hollywood’s crossroads: Netflix’s deal revives digital-era vertical control, while Paramount offers a bridge to hybrid survival. Both paths prioritise scale over fragmentation, but neither fully addresses how to balance profitability with artistic freedom. Regulators, creators and audiences must weigh whether reacquiring monopolistic power risks stifling the diversity that defined cinema’s golden eras. Will this saga end in innovation or imitation? The coming regulatory reviews and shareholder votes will reveal if Hollywood adapts or simply swaps one giant for another.

Leave a Comment