The $450m Painting? : Interactions and Incongruences between Market Values and Artistic Values in Art Auctions

The $450m Painting? : Interactions and Incongruences between Market Values and Artistic Values in Art Auctions

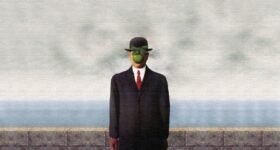

Unlike traditional investments like shares or bonds, whose prices reflect the discounted net economic benefits expected over an observable future, valuing artistic endeavours is often perceived as complex task that is usually left to the judgment of historians and art experts. The fundamental problem of determining the monetary value of art cyclically resurfaces during auctions of renowned artworks. For instance, in the Autumn of 2017, Christie’s held a historic auction of Da Vinci’s “Salvator Mundi,” which sold for an astronomical US$450.3 million, the highest price paid for an artwork since Picasso’s “Woman of Algiers” in 2015 (Freeman, 2017). As news of the auction spread across global communication channels, questions arose from academics in various disciplines whose inquiries were later compiled into the 2021 documentary titled “The Lost Leonardo.”

What factors play into the fair value determination of a historic artwork? How does the economics of auction markets justify the staggering price tag of the “Salvator Mundi”? Can contemporary market theory be applied to art auctions, and can formulaic approaches assist in the valuation of art? This article, part of a three-part series, and in the context of the “Salvator Mundi” auction, systematically analyses the first of these questions on what factors play in the price determination of an artwork with specific focus on artistic and market values interact with each other. Together, both articles attempt to redefine our contemporary comprehension of arts auctions and cumulatively assess the extent to which the “Salvador Mundi” fits it exorbitant price tag.

What factors play into the fair value determination of historic artwork?

Before answering this question, it is important to make a crucial distinction between what constitutes as artistic value and market value. Predominantly artistic value is a reflection of the intrinsic worth of an artwork based on a broad range of subjective factors at the discretion of its critics like its cultural significance, emotional impact and critical acclamation while market value is based on observable and objective economic forces like the artwork’s scarcity and market dynamics usually accounted through a monetary figure. Intuitively the market value of an artwork is contingent upon its artistic value and at times these values maybe at disequilibrium although there is now a growing consensus that the two share a bidirectional relationship (Blum, 2021). In the context of Salvador Mundi for example, its fair value was predominantly derived from its association to Leonardo Da Vinci himself whose feats in multi-faceted disciplinary areas still remain a revered endeavour thus increasing the painting’s market value. Conversely, the market value of the Salvador Mundi as decided by the auction market at $450 million triggered artistic debates and renewed scholarly interests regarding the secrets and provenance of the painting which consequently increased its artistic value. This bidirectional relationship is one that is crucial to understanding the economics of arts markets, although frequent debates emerge regarding which value should systematically have a greater influence over the price of an artwork.

One interesting proposition was developed through research published by the University of Melbourne’s Arts faculty concluded that the increasing commercialisation of art coupled by overpowering salesmanship and dynamic market forces is reshaping the arts market such that the artistic value of an artwork is overshadowed by its market counterpart. This tendency tends to discriminate against the artist’s merit which calls for the innovation of methods and mechanisms that while persevering the intrinsic cultural and emotional significance of artworks allows the market value of an artwork to operate (Zhang, 2022).

Through a business-oriented lens, the outcome of Christie’s record-breaking $450.8 million auction is one that encapsulates how increasing commercialisation has led to market values overpowering artistic values in a way that exorbitant prices like this maybe a negative reflection of the artworks intrinsic worth. At first glance, it is feasible to state that the price was a result of the heightened competition among buyers to procure the scarce, one-of-a-kind artwork but extending beyond this argument we realise that marketing and branding in addition to prior ownership of the painting played a significant role in its final price determination. Christie’s compelling branding of the painting as the “Lost Leonardo” generated immense hype and anticipation which led to an associated media frenzy which may have overshadowed the painting’s intrinsic artistic qualities. Similarly, the artwork rocky past of having being owned by controversial figures could have also led to its grand price tag likewise overshadowing its artistic value. These figures with Charles I of England, Swiss dealer Yves Bouvier and Russian oligarch Dmitry Rybolovlev where the latter two were involved in a fierce legal dispute over the market price at which the painting was sold. Like previously stated the influx of market factors is what desecrates and debilitates the intrinsic artistic value of a painting which given the disputed provenance, cultural impact and authentic of the painting could potentially mean that the artistic value of the Salvador Mundi was significantly less that what was reflected through superficial market prices (Kjaer, 2021).

Despite the objectivity of market value over artistic value, the previous passages indicate its inefficacy of determining a ‘real’ price for an artwork just as imperfect capital and product markets today may understate or overstate the values of investments and commodities respectively. As described in the previously mentioned research, independent arts valuators are those responsible for assessing the intrinsic value of art before they allow markets to decide its final price. Art valuators assess artworks based on factors such as cultural and emotional significance, as well as technical attributes like colour and authenticity. They consider the artwork’s historical context, its impact on culture, and its ability to evoke emotional responses from viewers, recognizing these elements as core to its artistic value. In addition, valuators employ modern scientific visual examination techniques to analyse the physical properties of the artwork. These techniques include infrared reflectography, X-ray fluorescence, and pigment analysis, which help determine the authenticity, condition, and original colours of the piece. By combining these scientific methods with an understanding of the artwork’s cultural and emotional importance, valuators can provide a comprehensive assessment of its true artistic value.

Conclusion

In summarising the current insights, it is evident that artistic value and market value maintain a reciprocal relationship. However, commercial influences such as marketing, media, and supply and demand dynamics often cause market value to overshadow artistic merit. This trend is notably observed in art auctions like the 2017 sale of the Salvador Mundi. Buyers frequently prioritize superficial factors shaped by commercial environments—such as brand prestige and previous ownership—over the intrinsic qualities of the artwork when determining their purchasing decisions. Conversely, assessments conducted by art appraisers tend to offer a more accurate reflection of an artwork’s true value. These evaluations take into account cultural significance, historical context, and aesthetic appeal, factors which contribute to the artwork’s worth. Despite their subjective nature, such appraisals are generally regarded as providing a clearer assessment of value compared to market metrics. Looking forward, advancements in technology are expected to enhance the precision of art valuation processes, potentially making artistic value more objective and comparable to market indicators. This alignment would contribute to a more balanced consideration of both artistic and commercial aspects in the valuation of artworks.

REFERENCES

Blum, M. (2021, July 9). Auction mechanisms and the formation of prices in the art market. Theses.Hal. Science. https://theses.hal.science/tel-03648839/

Freeman, N., & Freeman, N. (2017, November 16). Leonardo da Vinci’s “Salvator Mundi” Sells for $450.3 M. at Christie’s in New York, Shattering Market Records. ARTnews.com. https://www.artnews.com/art-news/news/leonardo-da-vincis-salvator-mundi-sells-450-3-m-christies-new-york-9334/

Leonardo da Vinci’s “Salvator Mundi” | 2017 World Auction Record | Christie’s. (n.d.). Www.youtube.com. Retrieved July 27, 2021, from https://www.youtube.com/watch?v=3orkmMlSpmI

Kjaer, H. (Director). (2021). The lost Leonardo [Documentary]. Art Documentary Productions.

Zhang, X. (2022) The Value of Arts and Its Force: The Artistic Value and the Art Market, 638(1). https://www.atlantis-press.com/proceedings/icpahd-21/125969473

Leave a Comment